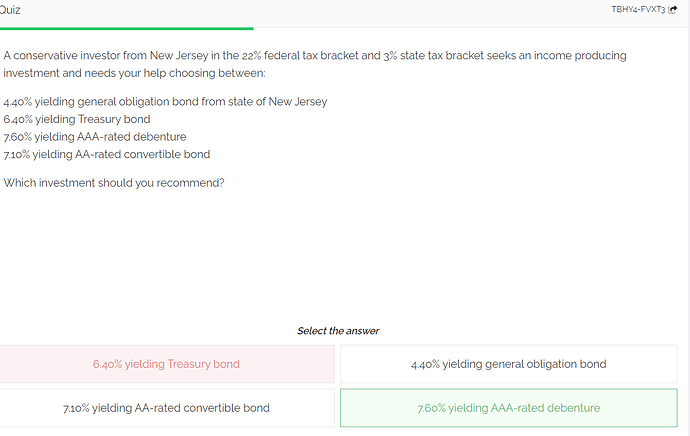

First of all, I think maybe it is some type of mistake on this answer, If not, can someone give me a little more explanation about this question? To me the correct answer is Treasury bond. Thanks in advance

Hi @Clara, thanks for posting.

There was a typo in the question where it had a 3% state tax bracket instead of 4%, but I believe the explanation is still accurate. Can you explain your reasoning for why you feel the Treasury Bond would be the best choice?

From the explanation at: https://app.achievable.me/study/finra-sie/quiz/TBHY4#seed=FVXT3

First, all of these bonds are safe and suitable for a conservative (low risk) investor. The best option will depend on the highest after-tax return.

The general obligation bond yields 4.40% after-tax yield because the investor pays no taxes on the income (they’re a resident).

The Treasury bond is taxable only at the federal level. To find the after-tax return, multiply the yield (6.40%) by 100% minus the tax bracket (100% - 22% = 78%). The after-tax return is 4.99%.

The debenture is a fully taxable corporate bond. To find the after-tax return, multiply the yield (7.60%) by 100% minus the applicable tax bracket (100% - 22% - 4% = 74%). The after-tax return is 5.62%.

The convertible bond is a fully taxable corporate bond. To find the after-tax return, multiply the yield (7.10%) by 100% minus the applicable tax bracket (100% - 22% - 4% = 74%). The after-tax return is 5.25%.

The debenture provides the highest after-tax yield and is the best answer.

Now I can read better than at 5:30am and I got the answer right LOL.

Thank you ![]()

All good! If there is anything that looks out of place or could use Clarification (get that one a lot?) let us know ![]()